Western Australian Wine Industry Sustainability Survey – Summary Report

The Western Australian Wine Industry Sustainability Survey captured insights from 50 producers across all the state’s wine regions, revealing current practices, challenges, and opportunities.

These findings will inform Wines of Western Australia’s (WoWA) Sustainability Program’s Strategic Framework 2025-2029. The survey highlighted key concerns including adoption barriers, regional challenges, and financial considerations – all of which align with the framework’s core objectives.

The regional focus enables targeted solutions that address local needs while supporting broader state goals. By fostering partnerships and simplifying certifications, this framework helps producers achieve concrete sustainability targets.

The summary outlined here will shape the strategic direction through to 2029, ensuring lasting impact across communities and achievement of goals.

Regional Distribution and Production Analysis

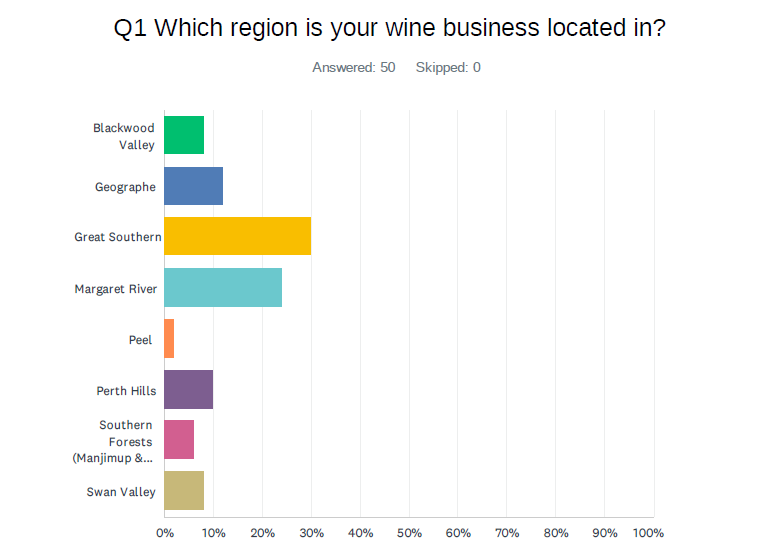

Representing approximately 16% of Western Australia’s wine producers (based on APC Wine Producers’ Committee Annual Snapshot 2023-2024 Financial Year, Vintage 2023), the survey received 50 responses.

The Great Southern had the highest participation (15), followed by Margaret River (12), Geographe (6), Perth Hills (5), Blackwood Valley (4) and Swan Valley (4), then Southern Forests (3) and Peel (1).

Most respondents had integrated businesses (wine producers and grape growers) (72%) and produced less than 50 tonne annual wine production (58%) and their major markets were direct to consumer (60%) and domestic (WA) (24%).

Those exporting (14%) were predominantly represented by wineries greater than 100 tonnes annual production.

Strategic Alignment

- Vision: Recognising WA’s global position as a sustainable wine leader starts with addressing region-specific challenges and opportunities.

- Actions: Regional collaboration and tailored programs, as outlined under the Licence to Operate strategy, ensure inclusivity across all regions.

1. Sustainability Awareness and Adoption

Awareness of Sustainable Winegrowing Australia (SWA) certification was high, but adoption rates varied by production scale. Larger producers (>500 tonnes) are more likely to have sustainability certifications, while smaller producers (<50 tonnes) expressed barriers, such as cost and time constraints.

Represented by all production scales, 24% did participate in sustainability programs, with 14% percent certified (predominantly SWA members) and all located in Margaret River. Strategic Alignment:

- Objective: Achieve critical mass adoption of ESG practices.

- Actionable Steps: Streamlining certification processes, offering financial incentives, and targeting communication efforts towards smaller producers.

2. Key Barriers and Motivators

Barriers: Time and financial constraints were the most cited challenges, particularly among smaller producers who struggle to allocate resources for certification costs and the ongoing investment required for sustainable practices.

The complexity of the certification process, including navigating multiple audits and paperwork, further deters producers, particularly with unclear return on investment of resources.

Limited technical knowledge and access to expertise were additional challenges, particularly for smaller operators.

Motivators: Reducing the financial burden through access to grants, subsidies or incentives would significantly motivate wine producers and growers to implement, adopt or enhance sustainable practices.

The potential for market differentiation and premium pricing were also strong motivators, especially for producers targeting export markets where sustainability credentials are increasingly demanded.

Environmental stewardship was a recurring theme, driven by both ethical considerations and the desire to preserve resources for future generations.

Respondents also noted the potential for cost savings in areas such as energy and water management as key drivers for adopting sustainable practices.

Strategic Alignment:

- Licence to Operate: Address barriers through streamlined pathways and incentives.

- Business & Workforce: Enhance training and development programs targeting small producers.

Survey Results at a glance

Workshop Preferences and Support Needs

Respondents preferred hybrid workshops combining online and in-person formats, emphasising practical, hands-on training.

Timing varied by region, with Margaret River preferring off-season workshops and Swan Valley favouring year-round accessibility.

Strategic Alignment:

- Research, Development & Adoption: Develop workshops and peer-learning networks tailored to regional preferences.

- Actionable Steps: Utilise feedback loops to refine training and ensure region-specific relevance.

5. Financial Considerations Across all production levels, government support, grants, and incentives were highlighted as critical enablers for sustainability adoption.

Strategic Alignment:

- Business & Workforce: Access government programs for financial support and capability development.

- Actionable Steps: Establish a matching grants/subsidy program and incentives for sustainability investments and certification adoption.

6. Regional Characteristics and Needs

Each region faced distinct sustainability challenges. The survey offered 16 priority areas for selection, but a noted limitation of the survey was the lack of a request for respondents to select their top 3–4 priorities only.

In regions with four or less respondents, this resulted in less definitive prioritisation. However, across all regions, clear trends emerged in the overall priorities.

The top five priority areas across all regions were:

- Water management and conservation (30 mentions)

- Soil health and regenerative agriculture (30 mentions)

- Sustainability certification options (23 mentions)

- Sustainable packaging and waste management (23 mentions)

- Circular economy practices and waste reduction (23 mentions)

Biosecurity, carbon footprint reduction and waste management and recycling solutions were the next three with 22 votes each.

Below are six priority areas for each region, ranked by frequency of selection or alphabetically where equal in rank. For specific details for each region please refer to the accompanying survey data.

Blackwood Valley (4 respondents) Sustainability certification options

Circular economy practices and waste reduction

Energy efficiency and renewable energy adoption

Social responsibility and community engagement

Access to new grapevine genetic material for resilience and quality improvement

Biodiversity conservation and habitat protection

Geographe (6 respondents)

Energy efficiency and renewable energy adoption.

Social responsibility and community engagement.

Soil health and regenerative agriculture.

Sustainability certification options Sustainable packaging and waste management.

Water management and conservation.

Great Southern (15 respondents)

Soil health and regenerative agriculture.

Water management and conservation.

Biodiversity conservation and habitat protection.

Carbon footprint reduction and carbon credits.

Climate change adaptation and resilience.

Sustainability certification options.

Margaret River (12 respondents)

Biosecurity measures and prevention of pest and disease.

Sustainable packaging and waste management Water management and conservation.

Circular economy practices and waste reduction.

Carbon footprint reduction and carbon credits.

Governance and compliance with environmental regulations.

Peel (1 respondent)

Biodiversity conservation and habitat protection.

Biosecurity measures and prevention of pest and disease.

Carbon footprint reduction and carbon credits.

Climate change adaptation and resilience.

Fire management and bushfire preparedness.

Governance and compliance with environmental regulations.

Perth Hills (5 respondents)

Soil health and regenerative agriculture.

Waste management and recycling within vineyards.

Carbon footprint reduction and carbon credits.

Climate change adaptation and resilience.

Biosecurity measures and prevention of pest and disease incursions.

Circular economy practices and waste reduction across the industry.

Southern Forests (3 respondents)

Water management and conservation.

Biodiversity conservation and habitat protection.

Fire management and bushfire preparedness.

Governance and compliance with environmental regulations.

Social responsibility and community engagement.

Soil health and regenerative agriculture.

Swan Valley (4 respondents)

Access to new grapevine genetic material for resilience.

Circular economy practices and waste reduction.

Governance and compliance with environmental regulations.

Soil health and regenerative agriculture.

Supply chain sustainability and ethical sourcing of materials.

Sustainable packaging and waste management.

What next?

Key outcomes of this survey are to provide direction not only for the strategic plan 2025-2029 but to inform the content of the next round of workshops to be delivered in May and June 2025 across the regions.

Half day workshops will continue to bring focus to sustainability certification adoption; sharing tools developed to assist with this process and offering insights into alternative programs to Sustainable Winegrowing Australia for simplified carbon emissions reporting.

To ensure an engaging and relevant program this needs to be integrated with key priority areas provided above, demonstrating how sustainability programs can be used as tools for improvement across business management and operations.

Proposed Workshop Themes for May–June 2025 Each half-day workshop would include expert presentations, case studies, interactive discussions, and practical tools for producers and growers to implement.

1. Water, Soil & Vineyard Resilience

· Focus Areas:

Water management and conservation

Soil health and regenerative agriculture

Access to new grapevine genetic material for resilience and quality improvement

· Key Discussion Points:

Strategies for water efficiency in vineyards

Soil regeneration techniques for long-term sustainability

Exploring new grapevine genetics for climate resilience

· Relevant Regions:

Geographe, Great Southern, Southern Forests, Swan Valley, Blackwood Valley

2. Waste Reduction & Circular Economy in Wine Production

· Focus Areas:

Circular economy practices and waste reduction

Sustainable packaging and waste management

Waste management and recycling within vineyards

· Key Discussion Points:

Reducing packaging waste and adopting sustainable alternatives

Practical approaches for winery waste recycling and upcycling

Industry case studies on circular economy applications

· Relevant Regions:

Blackwood Valley, Geographe, Margaret River, Perth Hills, Swan Valley

3. Carbon, Climate, & Energy Solutions for Wineries

· Focus Areas:

Carbon footprint reduction and carbon credits

Climate change adaptation and resilience

Energy efficiency and renewable energy adoption

· Key Discussion Points:

Practical steps for tracking and reducing carbon emissions

Climate adaptation strategies for vineyards

Renewable energy options and efficiency improvements

· Relevant Regions:

Great Southern, Margaret River, Peel, Perth Hills

4. Governance, Biosecurity & Social Responsibility in Winegrowing

· Focus Areas:

Biosecurity measures and pest/disease prevention

Governance and compliance with environmental regulations

Social responsibility and community engagement

· Key Discussion Points:

Protecting vineyards from biosecurity threats

Compliance and regulatory requirements for sustainable winegrowing, focus on wastewater management.

Building stronger community engagement and workforce sustainability

· Relevant Regions:

Margaret River, Peel, Perth Hills, Southern Forests

Your feedback on which workshop themes you would like to see in your region is welcomed.

1. Water, Soil & Vineyard Resilience

2. Waste Reduction & Circular Economy in Wine Production

3. Carbon, Climate, & Energy Solutions for Wineries

4. Governance, Biosecurity & Social Responsibility in Winegrowing

We value your input! In the interests of coordinating presenters for specific topics please nominate your two preferred themes ranked 1 and 2 by 31 March. Where possible workshops will be made available virtually or shared online later.

This survey is a crucial step in shaping our industry’s sustainable future. We encourage you to read the full report for in-depth insights specific to your region and production scale. Together, we can position Western Australia as a global leader in sustainable wine production.

Thank you for your participation and commitment to a sustainable WA wine industry.

Best regards

Eloise Jarvis

Wines Of WA Sustainability Program Manager